In today’s part 2 of DeFi Explained, we want to find out what synthetic assets are, how they can be useful. We’ll also find differences in current applications on Ethereum. Note, that we won’t look into Bitcoin futures and such.

In our DeFi Explaind series, we deconstruct open finance applications. Part 1 explained lending protocols. In part 2 of our series, we want to make sense of synthetic assets on Ethereum 📊

Previous knowledge needed: _Not a lot_👍

Part 1 of this series looked at lending protocols and can be found here.

Why Synthetic Assets?

**Synthetic assets **are financial instruments that simulate another asset’s payoff. In that way, they are synthetic, not the actual asset, hence the name.

Any difference between synthetics and derivatives? Those names are often seen in the same context (e.g. Investopedia’s examples for synthetics and derivatives).

In our case, we are simply using derivatives as instruments that simulate other assets’ payoff and synthetics as derivatives that use a mix of assets/derivatives.

Why should I buy a synthetic asset anyway?

That’s interesting for people who can’t or don’t want to hold the original asset. Think about a user wanting to hold USD on a blockchain. Only a synthetic token can bring a real USD on-chain.

Again, if you buy the synthetic asset, you simply get the same exposure (think of it as price or cash flows) as buying the original instrument(s). Selling synthetic onchain-USD for ETH gives you the same exchange rate as real USD, if done right.

If done right? Risk.

Yes, synthetic assets can go wrong (e.g. countless oracle incidents) and on-chain USD can lose its peg to the real USD. You could argue that with increasing complexity, risks of holding those assets increase as well.

And, even an on-chain USD can be simple or complex. Speaking of which, here comes our first use case: synthetic USD.

USD on DeFi — USDT vs. Dai — Who do you trust?

You might have heard of USDT, USDC, TUSD …. or other USD stablecoins on Ethereum.

All of them are **partly or fully backed by real USD **(or other real-world assets) and promise to be always able to be returned for USD. Of course they bring the real-worldly challenges of having to trust that promise.

MakerDAO on the other hand aims to bring USD to Ethereum without this counterparty risk. Its stablecoin Dai aims to be running completely within the closed system of the Ethereum blockchain.

Using MakerDAO the users lock ETH (or other tokens) to generate a (smaller in value) amount of DAI. Since the collateral (i.e. locked ETH or tokens) amount is always higher Dai keeps the promise of being backed by more than enough value. (Risk hint: Until it isn’t.)

Until it isn’t? Risk.

This system however brings other challenges of keeping Dai pegged around 1 USD. (We won’t go into details here, but suggest checking MakerDAO’s blog.)

Simply put: MakerDAO’s smart contracts define a few rules aimed at incentivizing users to create and destroy DAI (i.e. increase and decrease supply or demand) in a way that keeps the DAI value somewhat pegged to the USD.

Bitcoin on DeFi — cross-chain, made simple

Of course you can not only synthesize USD, but also put the value of other native tokens onto Ethereum as well.

WBTC, tBTC and imBTC, for example, aim to bring Bitcoin’s value to Ethereum. Both work very similar to the USD tokens: imBTC can be created from Bitcoin and later returned to receive Bitcoin, which is — in the meantime — locked on the Bitcoin chain.

Tokenlon DEX, also puts Cosmos ATOM and EOS tokens on Ethereum, creating a simple benefit to you, the user: When buying ATOM or EOS on Tokenlon, you are actually atomically exchanging ETH to vATOM or vEOS (note: the v stands for virtual). As soon as that vToken lands in your wallet, Tokenlon sends you the real ATOM or EOS into your pre-defined wallet.

In this way, the **vTokens are a way to on-chain verify **the trade itself. Even if Tokenlon wouldn’t send you the native tokens (which won’t happen😊), you can always prove the trade.

Thus, Tokenlon adds a guarantee that you miss when trading cross-chain on Shapeshift or other centralized swap tools.

In this case, we use a synthetic token to help you trust Tokenlon: Cross chain, made simple.

You might have guessed that synthetic assets don’t stop with bringing USD or Bitcoin to Ethereum. No. It gets even more sYnTH3tiC 🤪

General Synthetic Assets — where is the limit?

Now that we learned about USD, BTC, EOS, ATOM on Ethereum, let’s look into what other assets we can synthetically create, or simply simulate. Where is the limit?

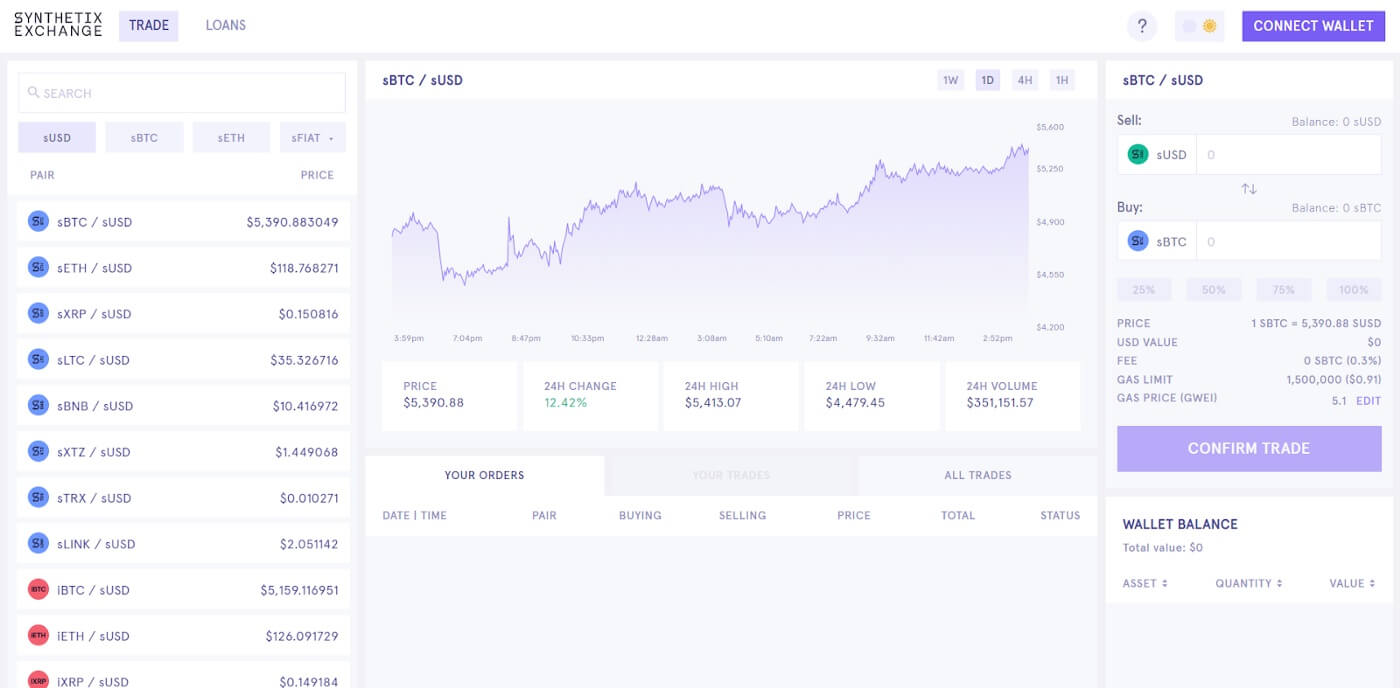

Synthetix

Synthetix currently offers to create/mint synthetic assets that are backed by collateral. That’s again like in MakerDAO.

In MakerDAO, however, you can (currently) only lock ETH, BAT, USDC as collateral. And, you can only create Dai.

Synthetix, on the other hand, allows you to **lock SNX **(i.e.Synthetix’ own token) and to (currently) create sUSD and sETH.

But the party doesn’t stop with sUSD and sETH. You can ‘exchange’ those tokens for other tokens, such as the **inverse iTokens **(e.g. iETH) or **sTokens **(e.g. sBTC) with an ‘exchange rate’ that is derived from price oracles.

Technically speaking, you are not exchanging sUSD to sBTC with someone else (like on an exchange), but simply asking the price oracle for Bitcoin’s price and adjusting your holdings accordingly, while the SNX collateral stays the same.

UMA

UMA (currently only on testnet) offers users to create derivatives called Total Return Swaps.

What? Let’s dive into that:

Let’s say you want exposure (i.e. owning the cash flows from price movements) to Bitcoin on Ethereum, just like imBTC or sBTC we mentioned above. In this case, you can use UMA to create an agreement where you pay another user DAI when the price of Bitcoin decreases and the other other pays you when it increases.

Unlike Synthetix, UMA therefore needs two parties involved. Both need to lock some tokens to guarantee their future payments to the other party.

However, neither of the two parties needs to lock the $5000 to guarantee payments on Bitcoin’s price movement. A smaller amount of collateral is enough to pay the respective other party on price movements.

Therefore, both parties are leveraged with a small amount of committed money while fully participating in Bitcoin’s price movement.

In fact, UMA even allows you to define the exact terms of how price movements influence your payments: Maybe each party only pays when Bitcoin’s price moves more than $100.

As long as you have an oracle for it (i.e. have some way to provide the price information to UMA’s smart contract), you can also create agreements on other assets, such as stocks or indices.

As long as you have a counterparty who wants to take the exact opposite side of your outcomes, you can use your UMA token as investment.

One extreme example of how a UMA token can be set up shows the approach of creating a USStocks token. In this case (see their blog post), one side collateralized the position, not partly, but to always more than 108.5% of the values of that US stocks.

Buying this token, a user can therefore always buy this stock token to gain exposure to the US stocks market in a 1:1 fashion.

That’s actually similar to buying a similar token on Synthetix, only that UMAs synthetic derivatives also have a fixed time. Synthetix tokens are perpetual.

As briefly mentioned above, UMA relies — just like Synthetix — on Oracles to receive the Bitcoin price — or any other value of your desired underlying.

Market Protocol

Similar to Synthetix and UMA, Market Protocol plans to bring exposure to blockchain and traditional assets in their own, unique way. Market protocol (also not released yet) follows UMA’s example in issuing synthetic assets that are backed by a comparatively small amount of collateral and therefore creating leverage for the user.

Their tokens also need an oracle to be priced and expire every 28days, and the person holding the synthetic token can claim the collateral.

However, in Market Protocol’s case, the tokens are always minted in pairs of two tokens: One short and one long position token.

That means, you would create a pair and then for example sell the long tokens to hold the short position on e.g. ETH, betting on decreasing ETH prices. That of course can be done in one interface:

Unlike UMA, however, Market Protocol’s tokens always have a priceCap and priceFloor defining up until which points (high and low) a token can profit: If you hold an ETH short token you won’t profit from ETH going to zero, but only to a limit. Same with the ETH long token.

The smaller the range in which you profit, the smaller the collateral requirements, because you can simply lose less.

Bonus: DAI derivatives

Now that we saw how collateral and oracles can work to create synthetic assets, let’s look into how we can create on-chain derivatives from existing on-chain assets.

CHAI.MONEY

Chai is an ERC20 token representing a claim on deposits in the DSR.

Wait, what? So, we already learned that MakerDAO uses a couple of mechanisms to keep the Dai token pegged to the US-dollar.

One of those mechanisms is the Dai Savings Rate (DSR). The DSR is risk-free interest that you get when you lock Dai in the Dai Savings Contract.

Where does the interest come from? The interest is funded out of the stability fees paid by people that create/mint Dai (i.e. paid by Vault users that locked collateral) and is 8% per year at the time of writing.

Now, CHAI is an ERC20 token like Dai but automatically earns the DSR. Similar to how cDAI (check out our last post including Compound) represents Dai supplied to Compound plus interest.

How does it work though?

The Chai token smart contract does two simply steps:

- Chai deposits your Dai into the Dai Savings Contract — a step you would otherwise manually do — and

- Chai issues you CHAI tokens into your wallet

- Later you use your CHAI to claim your original Dai + the Dai earner via interest

By the way, it also supports gas-less token transfers. More information here on Github.

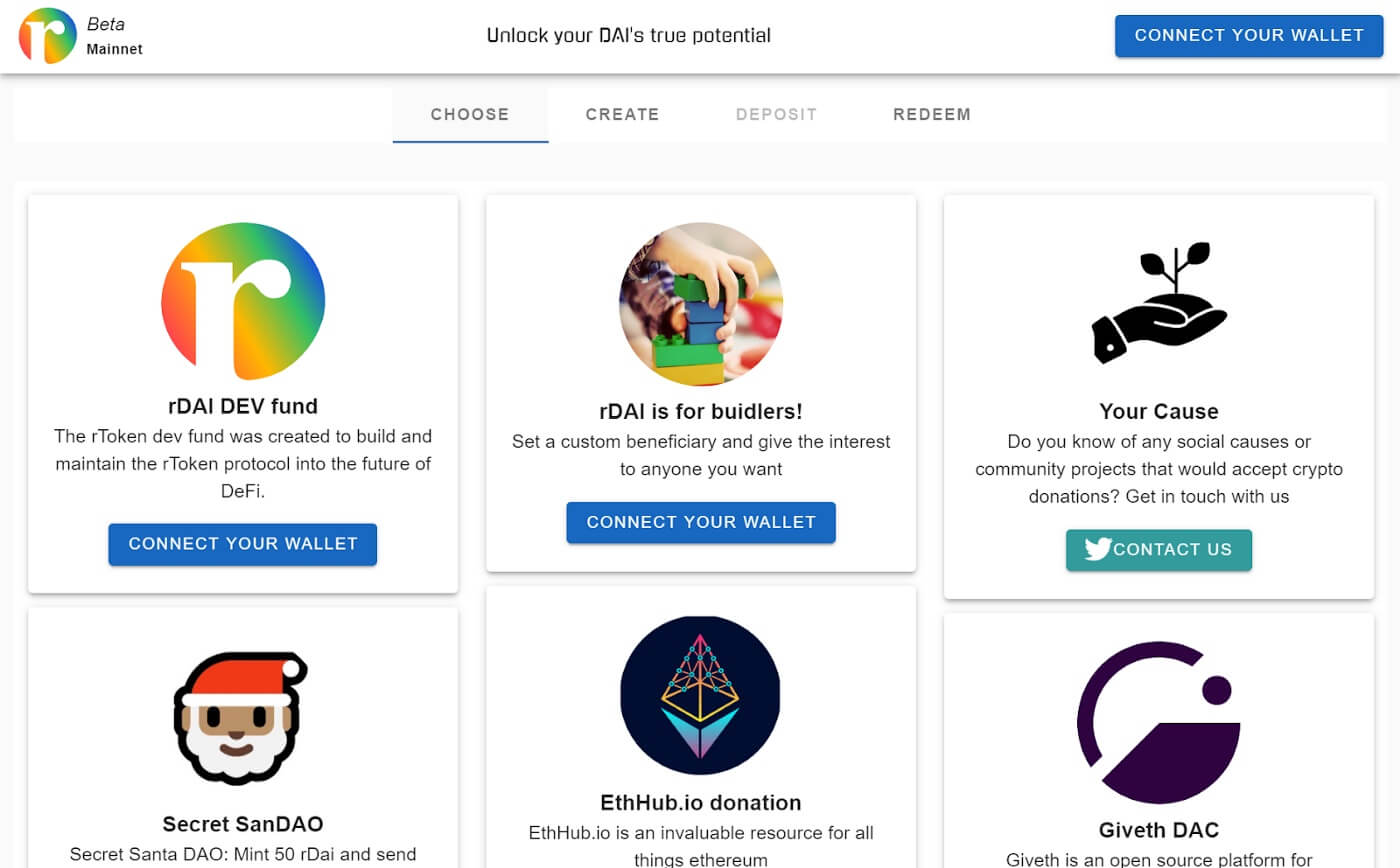

REDEEMABLE DAI (RDAI)

Since Dai offers this built-in interest and interest on lending platforms (read more about those in our first post here), some developers built tools to hold Dai while giving that interest away.

While PoolTogether buys you some kind of lottery tickets, RDAI offers you to send you interest to a recipient of your choice such as charity.

What you end up holding in your wallet is RDAI, which has Dai’s value as it’s 1:1 backed by Dai within a smart contract. No third party is able to change your collateral.

This concludes our dive into Open Finance Synthetics. Our next post will be about margin trading.

Check out other parts of our DeFi Explained series about:

Follow us on Twitter for more Ethereum Analysis and Technical Marketing insights!