DeFi lending protocols promise to let you borrow and lend just like with a bank, but with limited custodial risks as funds are stored on smart contracts.

Let’s find out what decentralized, border-less banking can do: Part 1: Lending protocols 📊

In our DeFi Explaind series, we deconstruct open finance applications. Part 2 on synthetic assets and all other parts can be found on our blog here.

Lending and Borrowing on Ethereum: Here are your options

If you lend your tokens by locking your tokens in a lending protocol, you will — just like with a traditional bank — receive an interest, mostly shown as _APY _or Annual Percentage Yield.

Borrowing a token, on the other hand, you would need to pay the _APR _or Annual Percentage Rate.

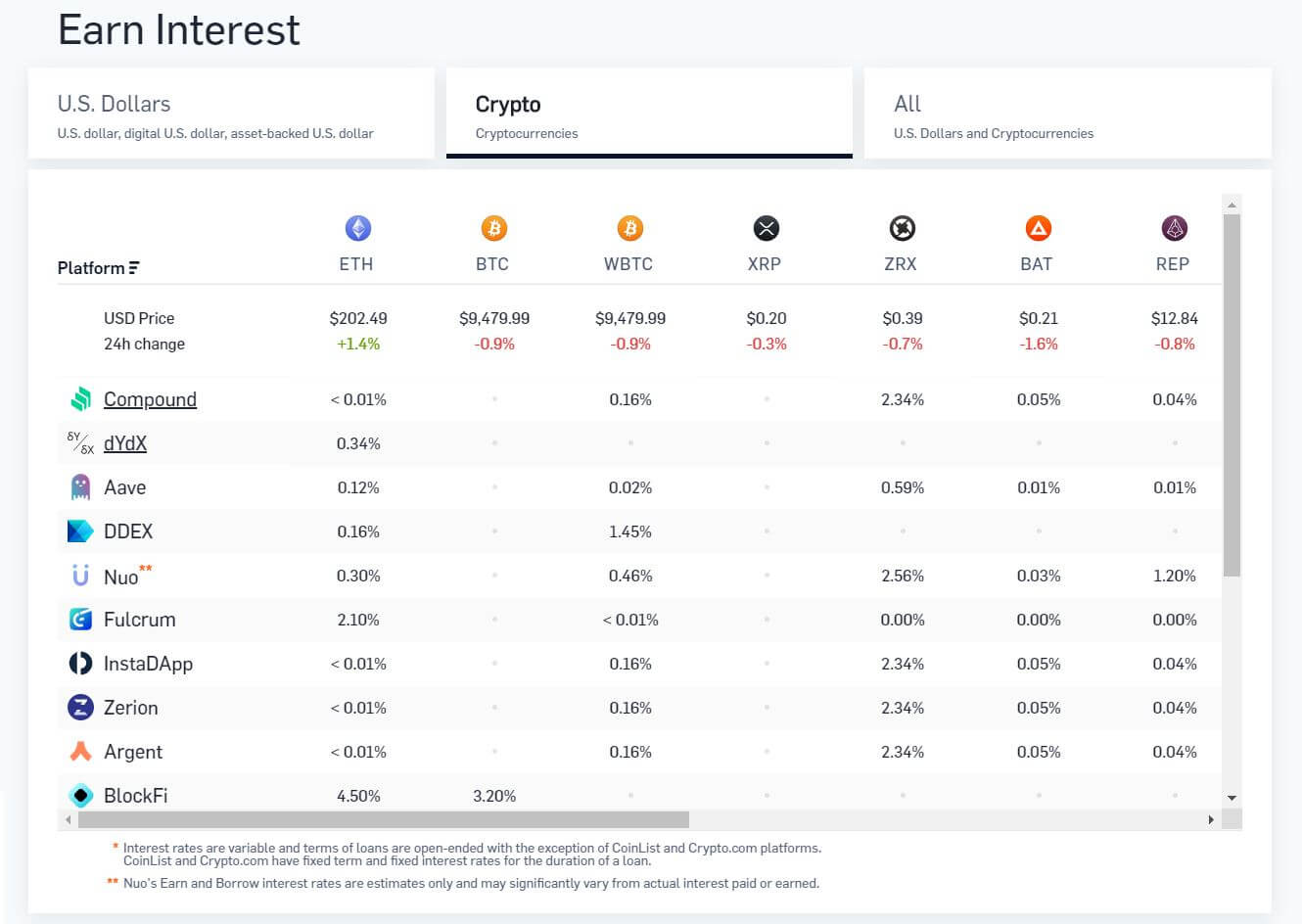

Where can I find the best rate? Well, that depends on your goal: Lending, trading, hold Bitcoin…, all of which we will show below.

What are lending protocols?

Lending protocols allow you to deposit funds and receive an annual yield in return. Besides depositing they also allow you to borrow tokens against your deposited tokens as collateral.

A lot of people use those applications as a way to borrow tokens for trading: They deposit — for example — ETH and borrow DAI for buying more ETH, thus owning a bigger exposure to ETH.

Having both lenders and borrowers in the same market, the price to borrow (i.e. the APR) is increasing with more tokens being borrowed.

Simply put: In a traditional market, tomatoes get more expensive with less fresh vegetables available in the winter. With lending protocols APY gets higher, if less people lend tokens.

Where can I start lending?

For every-day wallet users there are a couple of options to borrow and lend tokens in lending markets: Compound, Dharma, Linen, Aave, Dai Savings Rate.

Hint: Loanscan.io gives an overview of lending rates and historic data.

Compound is a lending protocol with a couple of available tokens for borrowing and lending: ETH, USDC, DAI as the biggest markets, but also for example WBTC and imBTC Bitcoin tokens.

Dharma and Linen aim to simplify earning interest by offering apps.

DAI token has its own lending tool: The Dai Savings Rate (DSR). The DSR is not defined by supply and demand on a market, but by the MKR token holders governing supply and demand of DAI itself: If a high demand of DAI decreases the stable coin’s price, MKR holders might want to decrease DAI supply by lowering the DSR.

Built-in interest — cDAI, aDAI, imBTC

Some of the lending protocols will actually send you a token into your wallet for lending. Depositing DAI token into Compound — for example — will send you cDAI tokens into your wallet. Lending one DAI on Aave will send you one aDAI.

Now, those Tokens will receive interest and can be traded on exchanges, which means that you can simply buy cDAI and start earning interest (e.g. on 1inch.exchange) without ever depositing DAI into Compound.

Other tokens have built-in revenue mechanisms by themselves: For example imBTC.

imBTC is an Ethereum Token issued with an 1:1 anchor to BTC. The holder can transfer, redeem, exchange imBTC as well as receive an income share of the Tokenlon platform fees while holding imBTC.

Margin trading for leverage — dYdX, Nuo

While we already mentioned that some people borrow tokens to trade those, we should add that there are platforms that make this use case very simple.

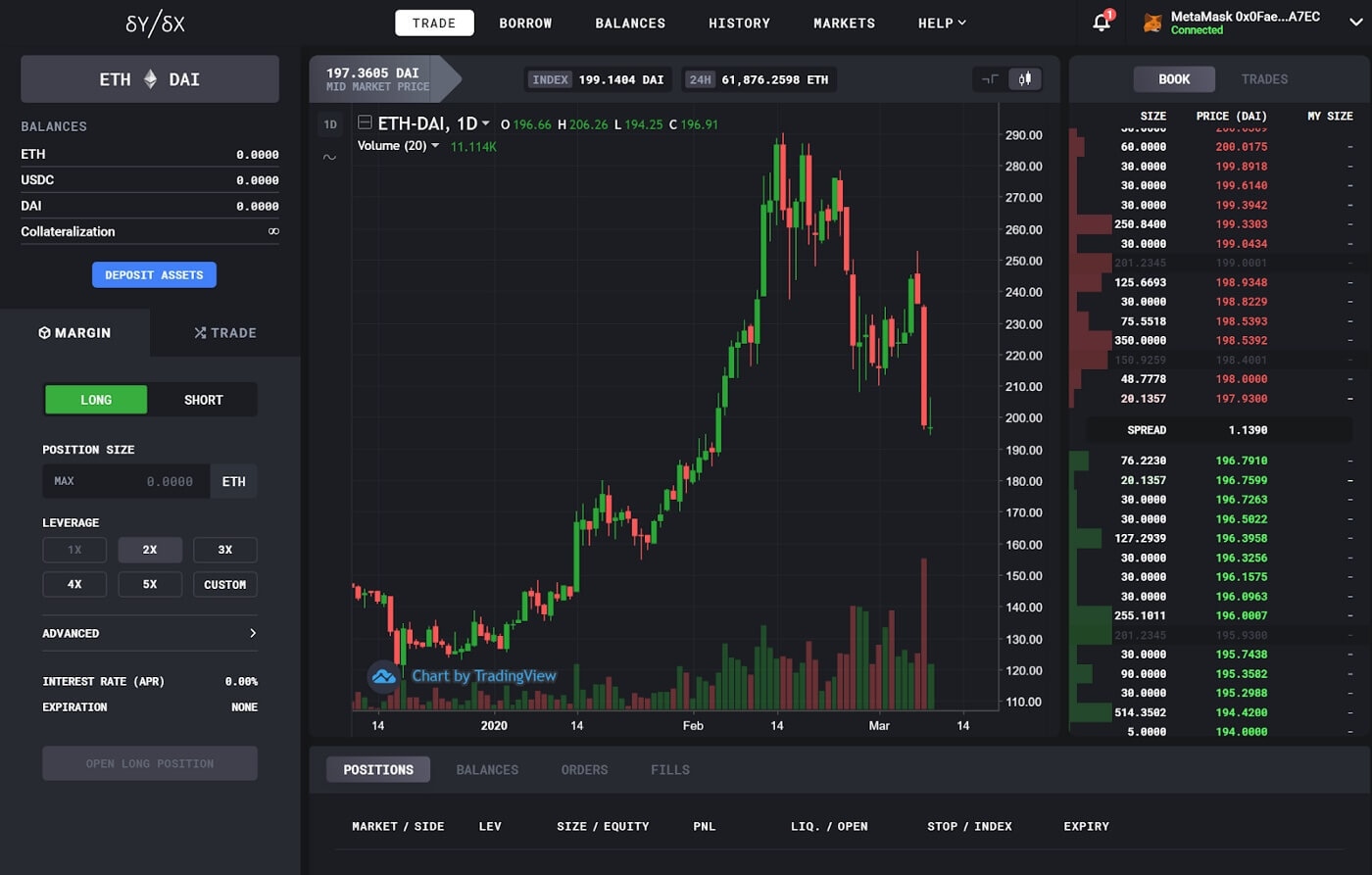

dYdX for one, let’s you deposit DAI tokens, which are then used as collateral in a number of trades:

- Margin Long ETH

- Margin Short ETH

You can either use one or multiple assets as collateral. If your account has 1 ETH, 100 USDC and 0 DAI and 1 ETH = 200 DAI, you can you can trade ETH with a leverage: Under the hood, the trade borrows DAI and sells it for ETH. If you went long 1 ETH, your balances at the end would read 2 ETH, 100 USDC, -200 DAI. The negative balance is an outstanding borrow, collateralized by ETH and USDC. This can also be achieved via the ETH-USDC market.

NuoLend works similar to this dYdx: Deposit a token which acts as collateral for margin trading.

(Read more about margin trading in DeFi in our DeFi Explained: Margin Trading here)

DeFi Robo advisors for the best rate — RAY

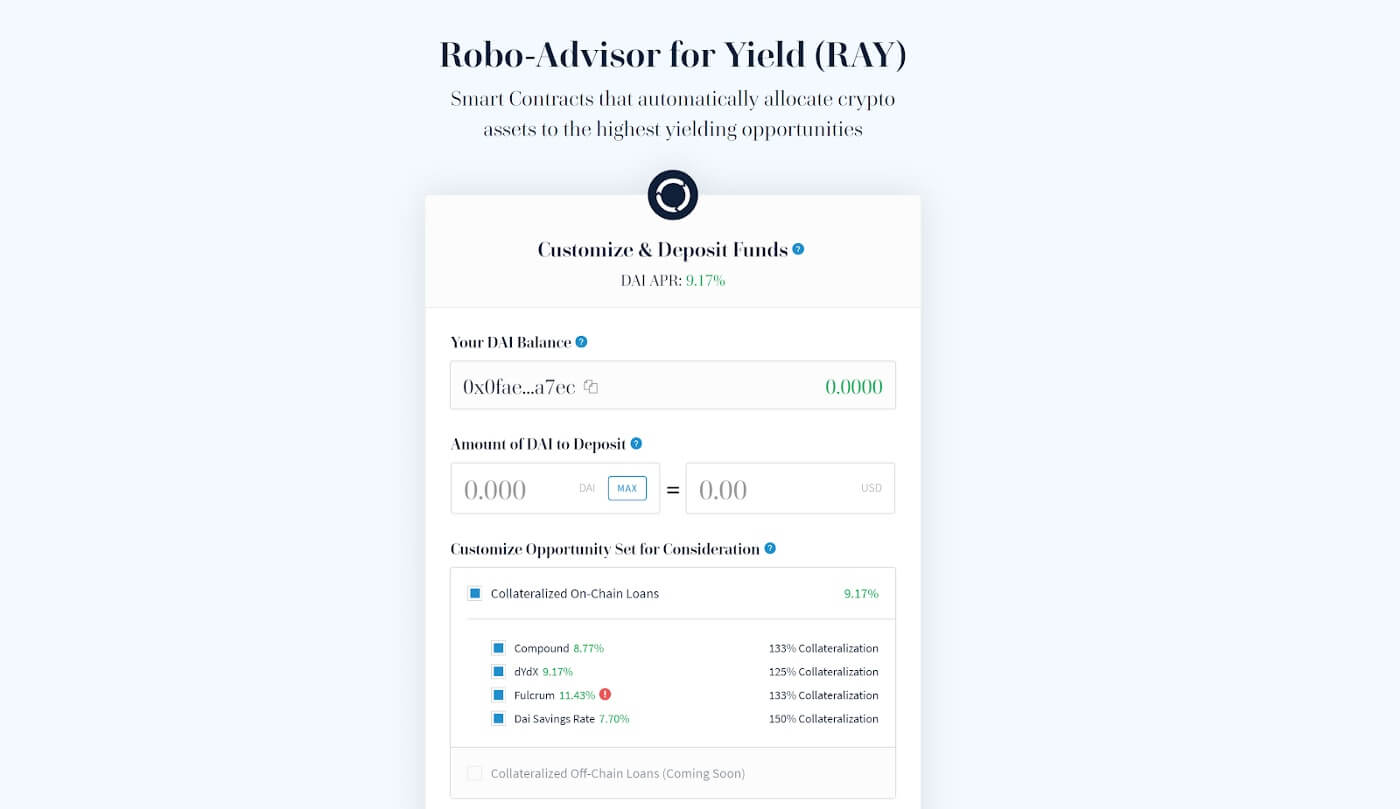

Similar to how some decentralized exchanges always find you the best price between different sources, robo advisors will find you the highest yield for your tokens.

The protocol with highest yield, however, changes over time which is why robo advisors automatically roll-over (i.e. withdraw and then deposit) your tokens into the protocol with highest yield.

Prominent examples are Idle Finance and Staked.us’ RAY.

RAY for example currently supports on-chain lending for ETH, Dai (DAI) and USD Coin (USDC) tokens via the Compound, dYdX, Fulcrum and Dai Savings Rate smart contracts, while Idle supports Fulcrum and Compound.

Check out other parts of our DeFi Explained series about:

Follow us on Twitter for more Ethereum Analysis and Technical Marketing insights!